In June 2023, the US job market slowed significantly, although employment growth was relatively good by historical standards. The unemployment rate reduced slightly while wage growth continued at a modest pace. Specifically:

The US government publishes two reports on the employment situation: one based on a survey of institutions; the other based on a survey of households. Firstly, the institution survey found that 209,0001[1] new jobs were created in the month of June. Although down from the rapid growth seen in May, it was comparable to job growth in March and April. The employment level was up 2.5% from a year earlier.

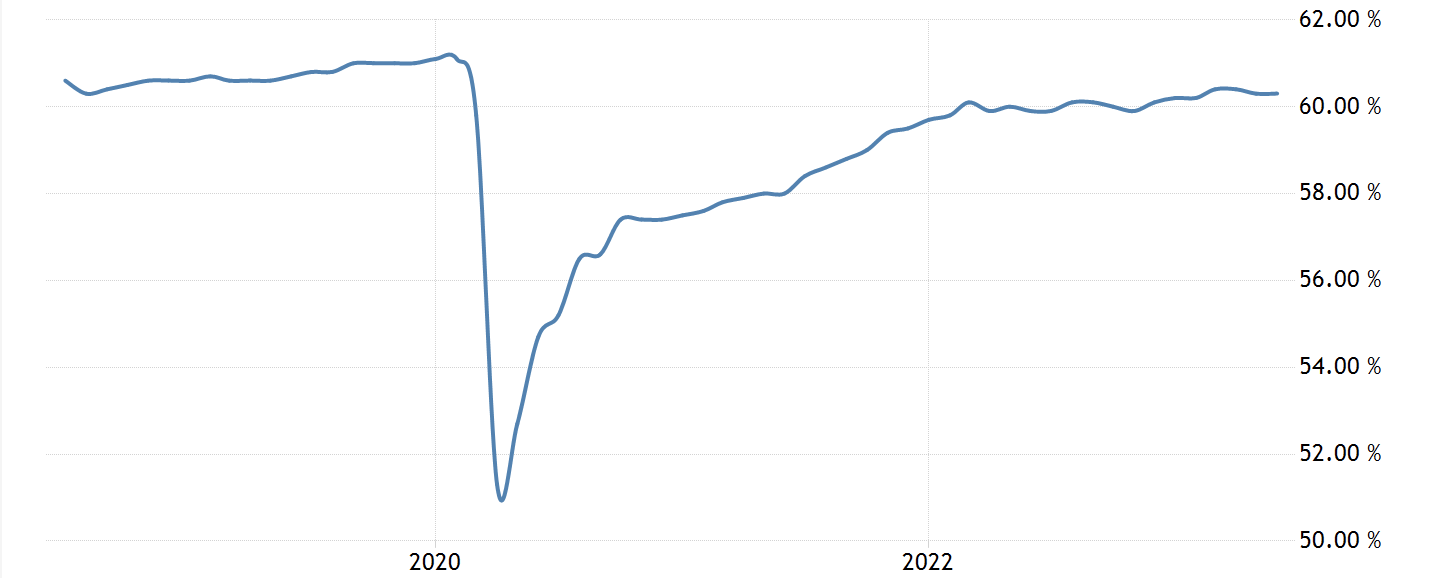

U.S. Employment Rate – Last 5 Years Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

Secondly, the US government published a survey of households that includes more than 9M people who are self-employed and found that the labor force grew in line with the growth of the working-age population, hence keeping the participation rate steady.

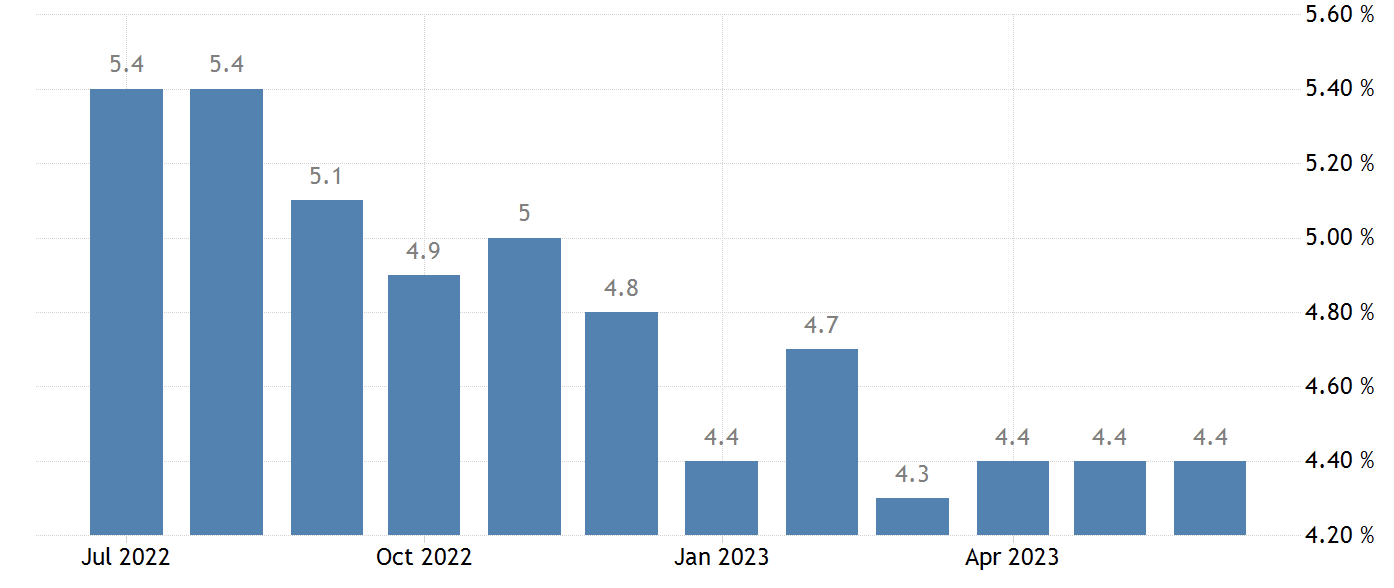

In addition, the government also reported that average hourly wages were up 4.4%[2] from a year earlier, the same rate of growth as in the previous two months.

U.S. Wage Growth rate YoY – Past 1 Year Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

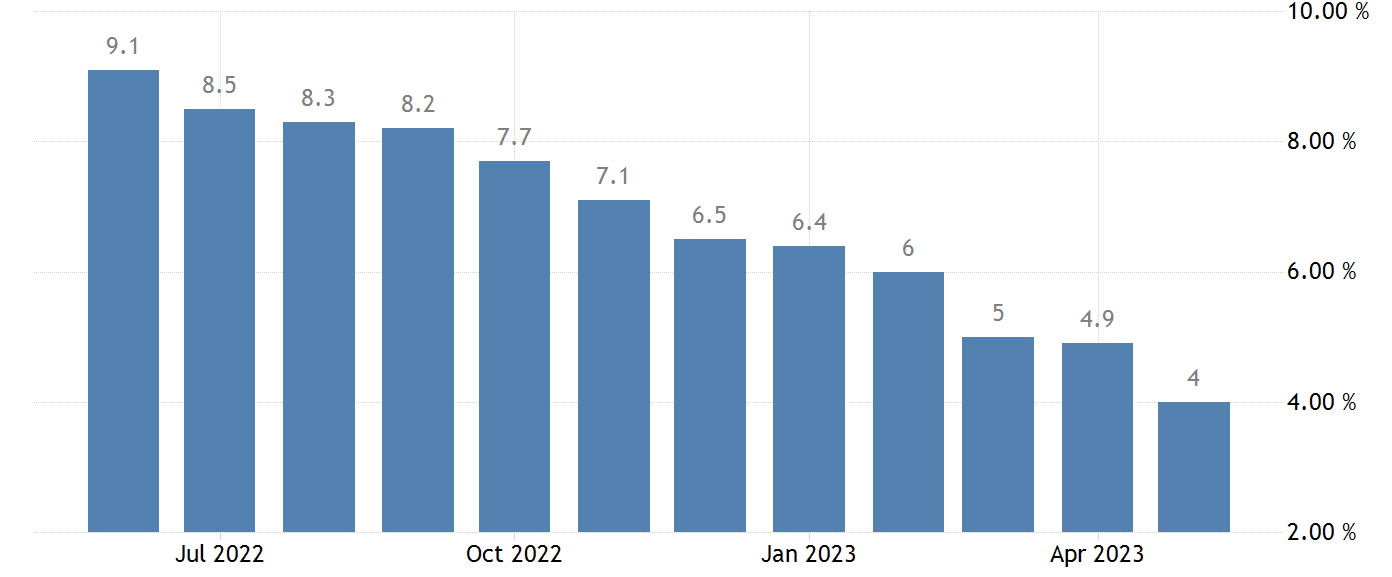

U.S. Inflation Rate – Past 1 Year Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

In conclusion, it seems that wage inflation is moderating at a rate slightly above the May’23 rate of inflation, which needs to go down for the Feds to pause the monetary tightening. A rise in wages would result in higher prices for goods and services available. The overall increased cost of goods and services has a circular effect on the wage increase; eventually, as goods and services in the market overall increase, higher wages will be needed to compensate for the increased prices of consumer goods. This kind of cycle is longer, more entrenched, and harder to reverse.

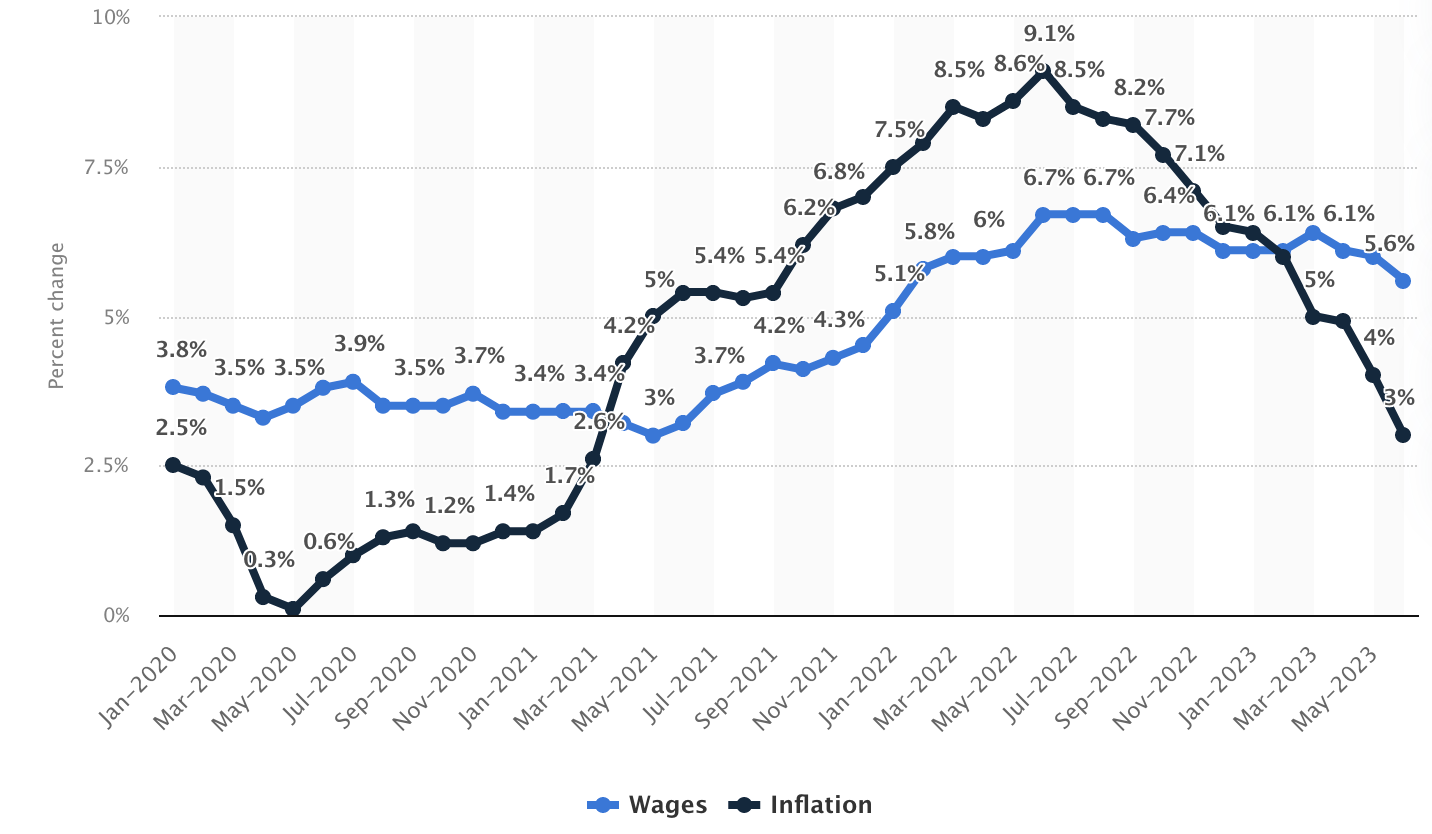

As per the chart below, the precedent shows that wage growth should be ~3% to fall in line with the target 2% inflation rate.

U.S. Wages vs Inflation Source: Bureau of Labor Statistics; Federal Reserve Bank of Atlanta; US Census Bureau

Source: Bureau of Labor Statistics; Federal Reserve Bank of Atlanta; US Census Bureau

Although a sign of economic recovery, if this continues, it will create additional pressure for the Fed to further suppress inflation, especially if productivity growth remains slow. Economists have determined a relationship between inflation and unemployment, described as the Phillips Curve, in honor of economist A.W. Phillips, who identified the relationship in 1958. The Phillips Curve hypothesizes that there is a correlation between inflation and unemployment. When inflation is high, unemployment is low. Conversely, when inflation is low, unemployment levels increase.

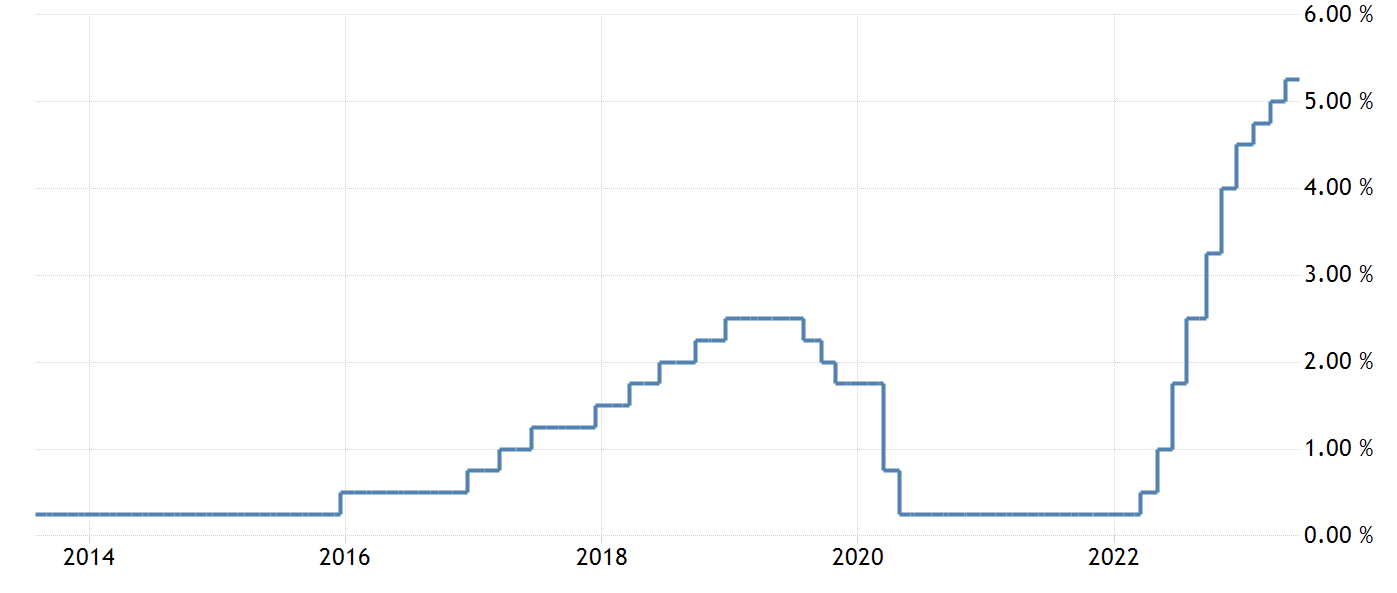

Consequently, there is a need to weaken the labor market to reduce wage pressure and bring down inflation. The Federal Reserve is anticipated to adopt a more stringent approach to monetary tightening that will likely result in an economic slowdown. This is already being factored in by the bond markets. On the other hand, stock markets are holding on to expectations of a decent economy. The future outcome remains uncertain, but history has shown, the bond markets have often proven to be accurate in their assessments.

U.S. Federal Funds Rate, Past 10 Years Source: U.S. Federal Reserve

Source: U.S. Federal Reserve

Times like these warrant investments that generate steady income irrespective of employment status or market environment – leverage Alphanso’s AI-based platform to curate a personalized portfolio that helps you become financially independent.

———————————————

[1] U.S Bureau of Labor Statistics – Employment Situation Summary, Friday, July 7, 2023

[2] U.S. Bureau of Labor Statistics