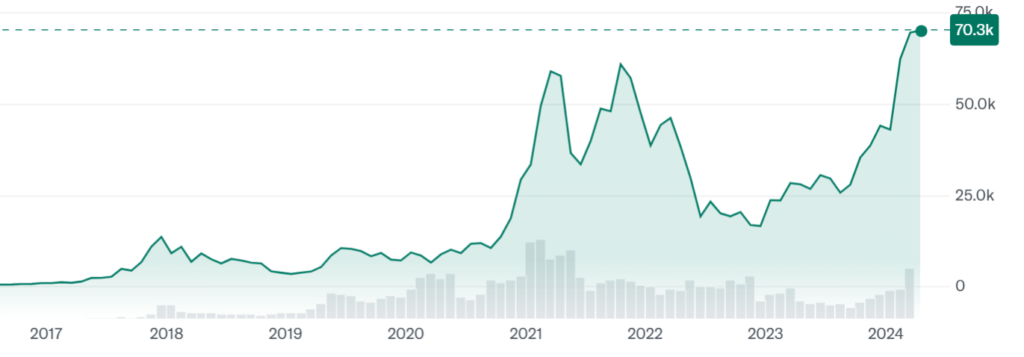

Bitcoin’s value plummeted below $62,000 on April 13, a stark drop from its $71,000 peak one day before, as a wave of selling hit the Cryptocurrency and equities markets, causing some altcoins to fall more than 15% in minutes.

If you’ve been following the crypto world, names like Bitcoin, Ethereum, and Dogecoin are likely familiar to you. These cryptocurrencies have been making headlines and enticing investors worldwide, and now even a bitcoin exchange-traded fund is available. If you’re considering investing, here are some key things you should know first.

What is cryptocurrency?

Cryptocurrencies, the digital or virtual currencies protected by cryptography, have surged in popularity in recent years. Their foundation lies in blockchain technology, a decentralized system maintained by a network of computers. Unlike traditional currencies, cryptocurrencies operate independently of central authorities, making them resistant to governmental influence or manipulation.

Transacting in cryptocurrency offers advantages such as privacy and low fees, as transactions bypass traditional banking systems. However, drawbacks include low transaction speeds and the absence of guarantees for deposits or principals.

Why do you need to think twice before investing in cryptocurrencies?

The SEC has long been skeptical of cryptocurrencies, with multiple agency leaders concerned the market is too volatile, investor protections are inadequate, and regulations are insufficient. Many published reports considered the SEC’s decision something of a reluctant fait accompli. With the approval came what some viewed as strong language from SEC Chair Gary Gensler: “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.” Below are some pointers that suggest that cryptos may not be the best investment opportunity for the long term.

- Greater volatility means greater potential losses: Bitcoin and other cryptocurrencies have a history of wild price swings, which could lead to significant losses if sold at the wrong time.

- Complex theories make it difficult to devise sound strategies: In the example of Terra Luna’s sudden collapse over three days in May 2022, many investors, particularly small-time players, were inclined to hold onto their investments, mistakenly believing that the market would bounce back, much like a declining stock. However, this optimism proved misguided, as the system didn’t recover amidst the panic.

- Uncertain compliance scares off potential participants: According to MIT Sloan’s Antoinette Schoar, regulatory ambiguity is a major deterrent for reputable players looking to enter the cryptocurrency markets. This uncertainty raises the barriers to entry and dissuades well-meaning individuals and firms from getting involved.

- The 24-7 nature of blockchain exacerbates existing risks: Unlike traditional financial systems, which have set operating hours, the blockchain never sleeps. This constant availability amplifies the potential for rapid market shifts and exacerbates the risk of panic-driven runs, without the safety nets provided by traditional banks.

- Persistent threats of fraud and cybercrime: Incidents of fraud and cybercrime have already occurred in the cryptocurrency realm, raising concerns about compliance with financial regulations. Bitcoin exchanges have experienced disruptions due to overwhelming demand, and the internet-based ledger system is vulnerable to large-scale cyberattacks, jeopardizing investor access in emergencies.

- Similar risks to cash: Access to cryptocurrency exchanges typically requires a login ID and password, leaving investors vulnerable to loss or theft if these credentials are compromised. While bitcoin can be stored offline in physical wallets for added security, the risks of loss, theft, or accidental destruction mirror those of traditional cash currencies.

- Cryptocurrencies lack tangible assets and rely solely on digital code for value: Unlike traditional investments backed by physical assets or intellectual property, cryptocurrencies are purely digital entities. This absence of tangible backing may amplify market volatility and introduce higher levels of uncertainty for investors, as their value is contingent upon technological infrastructure rather than tangible assets. Bill Gates once stated that Bitcoin has no intrinsic value, sparking debates over its fundamental worth and adding to investor skepticism.

- Potential Government Bans: The rise of CBDCs could position cryptocurrencies as direct competitors to national currencies, potentially prompting regulatory actions or outright bans. Governments may perceive cryptocurrencies as threats to monetary sovereignty and financial stability, leading to measures aimed at restricting their usage and investment opportunities. For instance, crypto trading and mining have been banned in China since 2021.