When it comes to aligning with financial goals, diversification stands out as an adaptable ally.

Research conducted by Ray Dalio conclusively demonstrates that strategic diversification can reduce risk exposure by a staggering 80% while simultaneously preserving returns.

What is Diversification?

Diversification is the process of spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of the investment portfolio. The risk in the portfolio of investment is made up of two parts- unsystematic risk also known as diversifiable risk or idiosyncratic risk and systematic risk (undiversifiable). In theory, an investor is supposed to get compensated for only the systematic risk they are taking. So, diversification is required to do away with unsystematic risk.

Diversification can occur within or across different asset classes as shown below:

Within the equity market, diversification can be attained by owning a sufficient number of stocks from varied sectors and industries. The cornerstone of diversification lies in the low correlation between different asset classes.

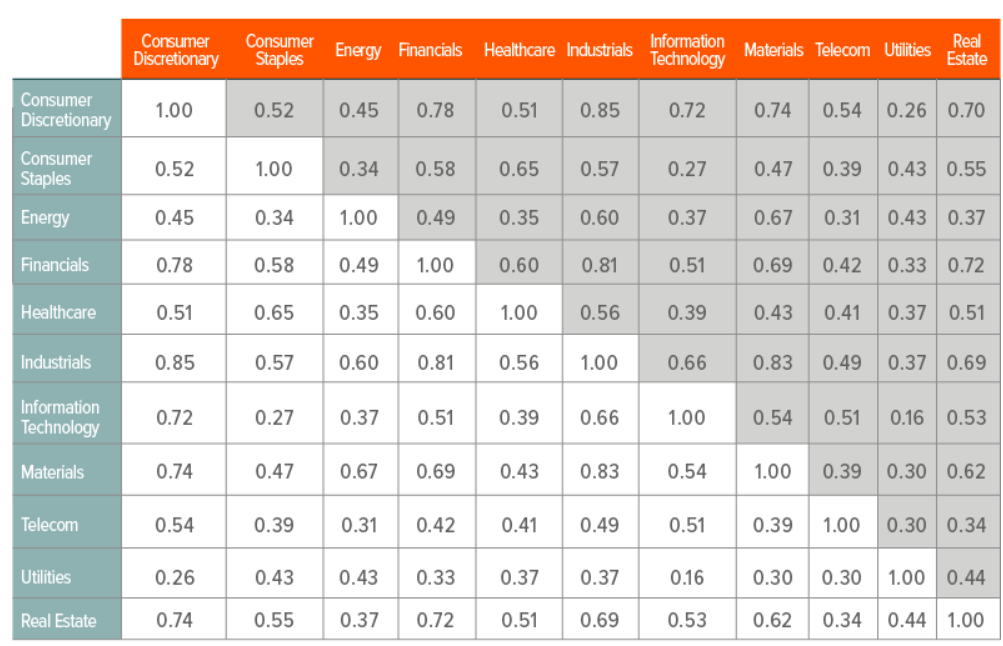

Here is a chart for the correlation between the S&P 500 sectors:

Evidence of Diversification in Work

Here is one such illustration of a diversified portfolio giving increased returns with the same risk.

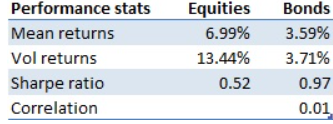

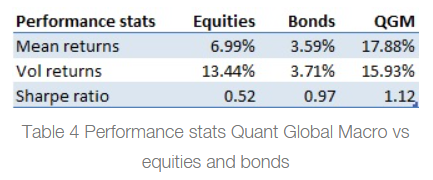

Consider a 60-40 portfolio using stocks and bonds that has following characteristics:

Mean returns – Average returns of any equities and bond over 15 years between 2003 to 2018.

Vol returns – Standard deviation of return of both the asset classes in the mentioned period. It is a measure of risk that is associated with any investment.

Sharpe Ratio – It is the measure of extra return for every unit of risk taken. Sharpe Ratio is used to measure risk-adjusted return. A higher Sharpe Ratio denotes better return per unit risk.

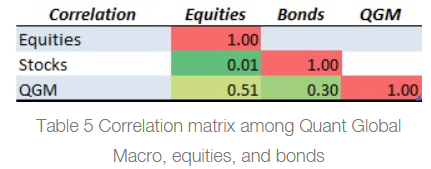

Correlation – It is the measure of the relation between returns of the two asset classes. Here we can see that a low correlation of 0.01 results in the diversification of the portfolio.

Here, in the 60-40 portfolio the high-risk equities and low-risk bonds can be combined to build a portfolio with a higher Sharpe Ratio than a pure equity portfolio.

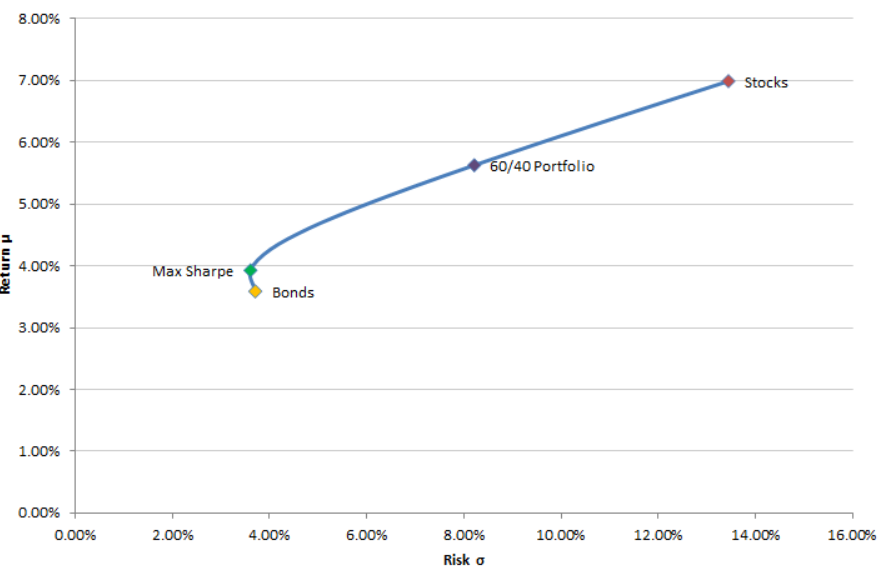

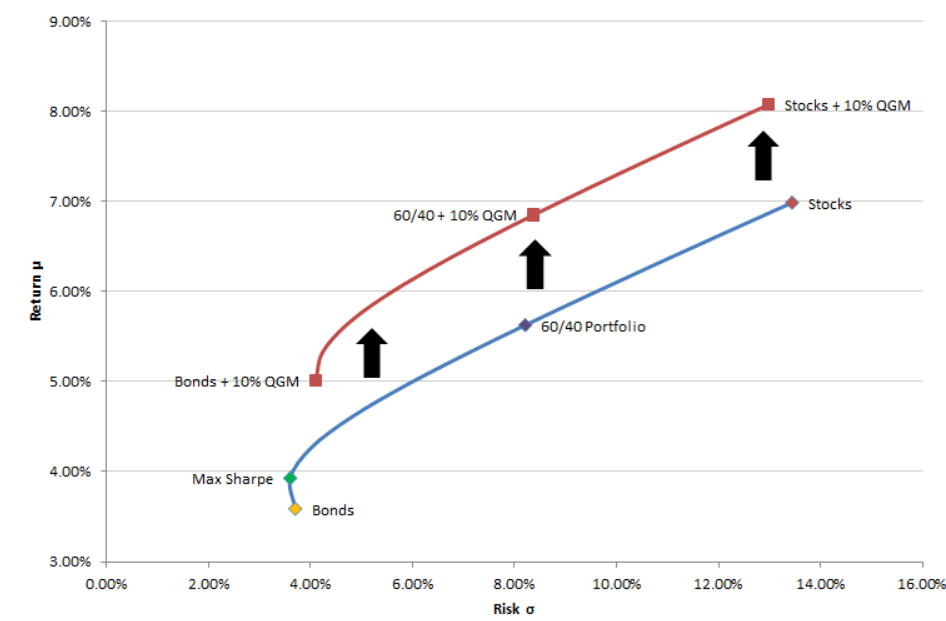

Efficient Frontier

We can see that for a 60-40 portfolio portfolio return is 5.63%, portfolio volatility is 8.21% and Sharpe ratio is 0.685.

Now, adding alternative investment can shift the efficient frontier up, and the return of equity asset class can be achieved at substantially lower risk.

60-40 portfolio with an infusion of alternative investment (Quant Global Macro) is illustrated below. We can see that a return of around 7% can be achieved at significantly lower risk.

We can see that a lower correlation between asset classes results in higher risk-adjusted returns.

How to diversify?

By incorporating a portfolio of at least 15 low-correlated return streams, individuals can significantly mitigate risks without sacrificing expected returns. Utilizing diversification allows for the effective management of beta, the measure of risk, while simultaneously overlaying a robust selection of investments to capture alpha, or excess returns.

Within the equity market, having exposure to sectors with lower correlation (Technology and Energy) can diversify the portfolio. However, it is important to note that sector stock is not enough to improve your odds. You need to find investment opportunities within that sector that will likely generate strong results in the future.

Across asset class by combining asset classes with low correlations (equity, fixed income, alternatives) among them, a superior risk-adjusted return can be achieved.

At Alphanso, we leverage the power of AI to conduct extensive market analysis, enabling us to offer investment recommendations that align with optimal asset allocation strategies. Take advantage of these benefits and begin your journey with us for free through our app.