The S&P 500 has shown remarkable growth this year, with a nearly 12% increase and the potential for entering a new bull market after surging almost 20% from its October low point.

However, beneath this seemingly positive trend lies a concerning phenomenon: the narrowing breadth of the market. A select group of mega-cap companies, considered safe havens during these uncertain times, has attracted the majority of investor attention and fueled the market rally.

The mega-cap companies driving the market rally include Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, Tesla, and Nvidia. These companies now account for 30% of the S&P 500’s total market capitalization and have been responsible for nearly all of the index’s gains this year. Such a concentration of gains in a limited number of companies indicates a narrowing breadth and raises questions about the overall health and sustainability of the market.

To put this into perspective, let’s compare the performance of the S&P 500 with its equally weighted counterpart. The equally weighted version assigns equal importance to each company in the index. In stark contrast to the traditional index’s 12% gain this year, the equally weighted version only experienced a meager 1.8% increase. This significant discrepancy represents the largest-ever outperformance by the S&P 500 on a year-to-date basis.

SP500 Performance v/s Equal Weight Counterpart

Is this a cause of concern for the investors? Unfortunately, we believe it is a yes.

A market is often deemed healthier when there is a greater number of stocks experiencing simultaneous upward movement. This phenomenon indicates a more robust and sustainable rally.

Historical Perspective

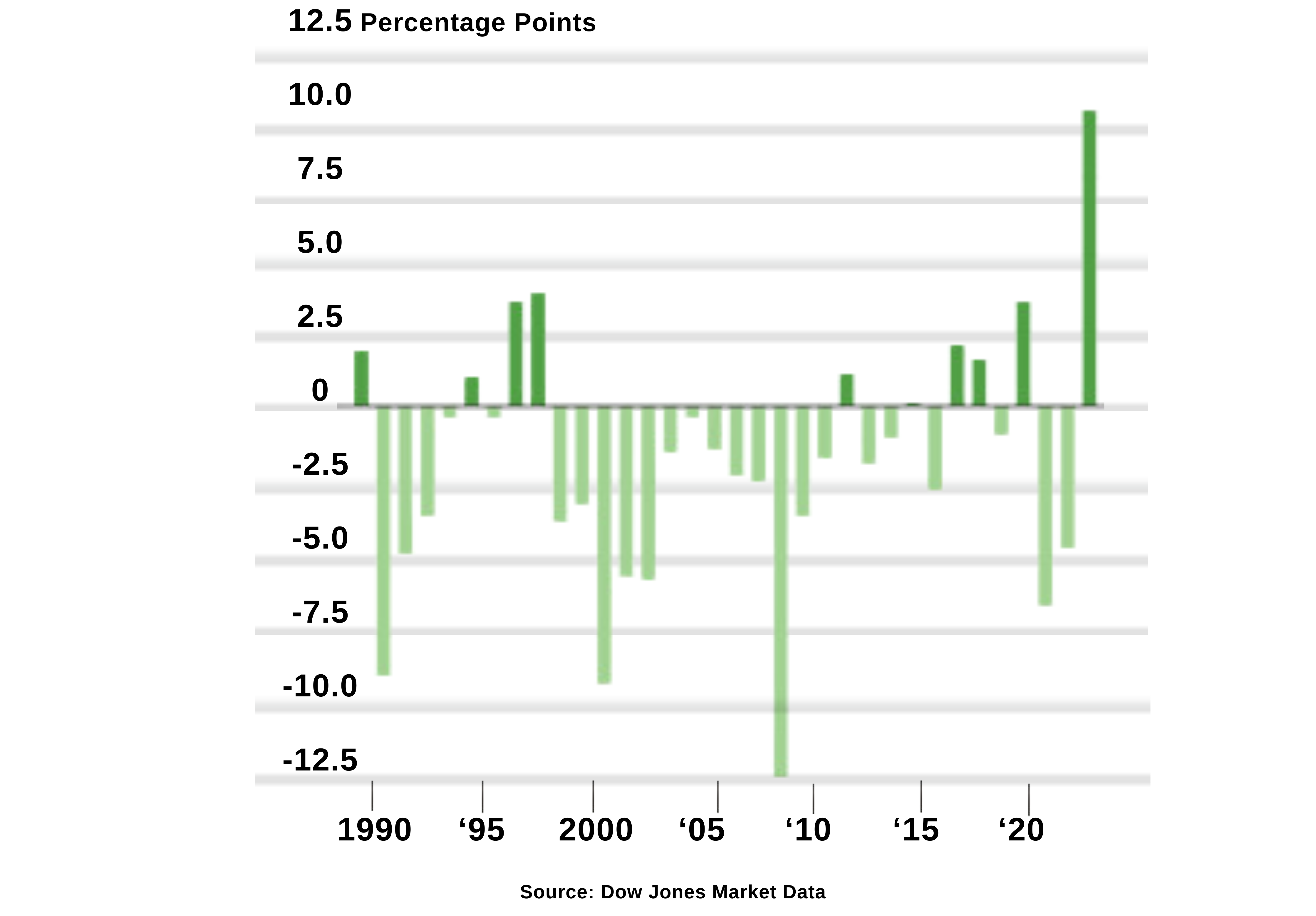

To understand the significance of market breadth, we can analyze historical data. Since the creation of the S&P 1500 in 1995, years with wider market breadth, indicating a greater number of stocks experiencing simultaneous upward movement, have generated an average annual price gain of 20.2%.

Conversely, years with narrower breadth, reflecting a concentrated market rally, have seen an average price decline of 6.2%. Over the span of 28 years, encompassing both wide and narrow breadth periods, the average price rose by 9.7%. This historical evidence emphasizes the importance of market breadth in assessing the health and sustainability of the market.

Analyzing Ratios

Another insightful way to examine market breadth is by analyzing the ratio between the Nasdaq 100, which heavily focuses on technology stocks, and the Russell 2000, representing a broader range of companies. By observing the graph, we notice the ratio is close to an all-time high and there is a pattern where a steep rise typically follows a steep decline in the ratio.

This trend has been evident in recent years and even during the 2000s, indicating the potential risks associated with a concentrated market.

Nasdaq 100 Index/Russel 2000 Index

Implications and Solutions

The narrowing breadth of the market raises concerns about underlying investor anxiety. While the excitement surrounding artificial intelligence and technology companies with strong balance sheets is understandable, relying heavily on a small number of star stocks can expose both the index and individual portfolios to sudden reversals if those stocks stumble or fall out of favor.

As investors, it is indeed crucial to participate in market evolutions, but it is equally important to remain mindful of fundamental realities and sell when expectations surpass them.

One key aspect to consider is the concept of quality. Many of this year’s significant winners are characterized as highly cash-generative companies with robust balance sheets. These are often referred to as “quality” companies. The common mistake that investors make is overpaying for highly acclaimed companies.

When a company is widely recognized as great, it is more likely to be overpriced compared to those that are less favored or attract less attention. In such scenarios, you are more likely to find hidden gems for investing that are being overlooked by the investors. These are characterized by strong balance sheets, free cash flows, and healthy margins while trading at reasonable multiples.

It’s also important to follow a balanced and diversified approach to find the best investment solution.

While mega-cap companies have played a significant part in driving market gains, it’s essential to consider the bigger picture and not rely solely on a select few stocks.

At Alphanso, we believe in leveraging the power of AI for in-depth market analysis, which enables us to offer you stock recommendations that align with optimal asset allocation strategies. Take advantage of these benefits and begin your journey with us for free through our website or by downloading our iOS or Android app.