Markets closed January on a strong note buoyed by strong earnings and economic data supporting the soft landing thesis. The S&P 500 index gained 1.7% during the month led by growth stocks, particularly in the technology sector.

The US 10-year Treasury yield was up 11 basis points to 3.96% as hopes of a March rate cut faded.

Several data releases highlighted the strength of the US economy. December saw a strong jobs report, adding 216k jobs with steady unemployment at 3.7% and notable wage growth. Additionally, fourth-quarter GDP surged to 3.3%, surpassing expectations.

Commodities performed well, as oil prices rallied due to tensions in the Middle East and disruption to shipping through the Suez Canal.

Given economic sentiments, the Fed can afford to be patient while deciding when to start lowering interest rates. With the looming impact of the Fed’s most significant hiking cycle in a generation, the economy’s resilience is likely to diminish over time. Nonetheless, our models still see a upside in the equity markets with greater emphasis on diversification and quality.

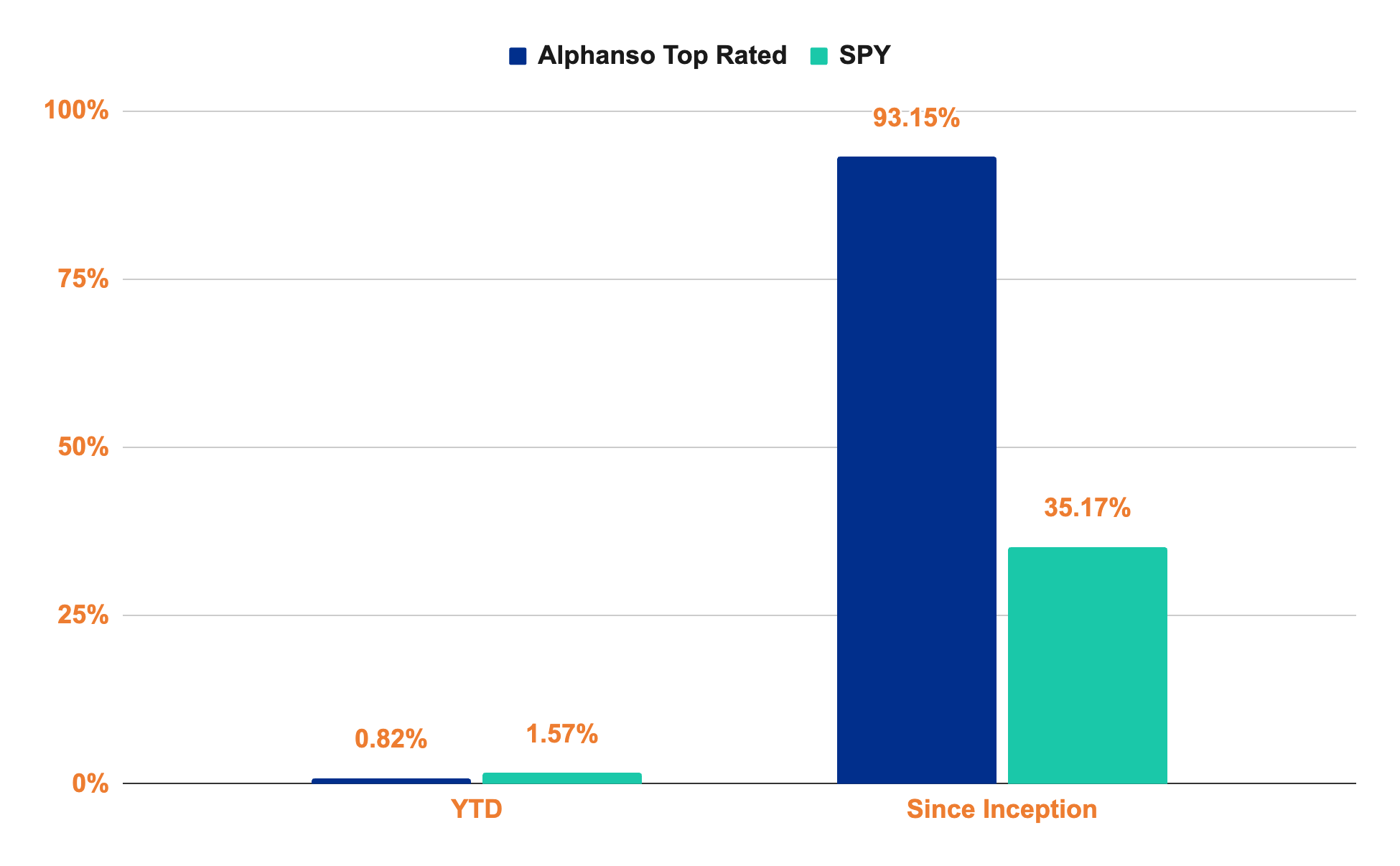

Alphanso Performance Update

Alphanso’s top-rated stock portfolio slightly underperformed, gaining 0.82% for the month.