The Holy Grail of Investing, a quotation ascribed to Ray Dalio for defining diversification, portrays his sheer ingenuity in the fields of investment.

This cleverly-crafted metaphor compels us to address the foremost question, why do we need diversification?

Imagine having a stock that constitutes a large portion of your portfolio. Say if it went down by 50% due to government policy changes, the repercussions would be the stock needing another 100% gain merely to reach back par. A situation like this makes an investor financially vulnerable, just like domino chips waiting for a single blow to fall. As a result, investor quits trading. A study by Tradeciety in the USA suggests that more than 50% of retail traders quit in two years.

2022 has been challenging for retail investors. According to data compiled by JPMorgan Chase, retail investors’ portfolios in the US fell 44% between early January and October 18.

Significance of Identifying Correlation

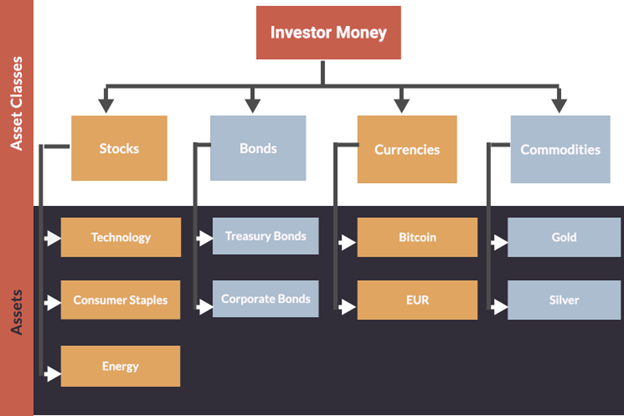

Diversification is one of the prime elements missing in almost every retail portfolio. In a true sense, buying assets in different classes can be a way of diversification. For instance, there can be a mix of stocks, bonds, currencies, commodities, and cash, as illustrated in the chart below.

An investor’s risk profile can help determine the allocation for each class. For instance, a risk-prone investor would likely invest more in stocks. But, for optimal diversification, it is quintessential to evaluate the correlation among the invested assets. Why? A thought-provoking study by Ray Dalio proves that this form of optimal diversification can help minimize risk by 80% without compromising returns. It may come as a surprise to many; the fact is that individual assets within an asset class are usually about 60% correlated with each other, so even if an investor thinks they are well diversified, they might be grossly mistaken.

Creating a Diversified Portfolio

The proper approach lies in diversifying your portfolio; in a manner that reduces risk without impacting returns. With at least 15 uncorrelated or 20 low-correlated return streams, one can dramatically reduce the risks without compromising on expected returns. Use diversification to manage the beta (risk measure) and overlay that with a robust set of investments for alpha (excess returns).

Challenges in Implementing Diversification

However, one of the considerable challenges to implementing this strategy is the need for advanced systems that run correlation tests at a deep level. Another hurdle is that as the investor rebalances/restructures the portfolio, the correlation between those assets can and does change over time based on myriad factors. Thus, if an investor wants to maximize the returns and minimize the risk, he must regularly re-evaluate and reconsider the investments, making changes when necessary on similar ground to changes in the global markets.

Rippled in this sublime analogy is the sagacity of Dalio, which reflects the larger image at one focal point; diversification is one of the salient qualities sought from portfolios. Once that action plan has taken shape, all that is needed is to strike the right balance between risk and expected return.