For context:

Inflation: Inflation is like a slow but steady rise in the prices of goods and services over time. Imagine if the cost of things you buy, like groceries, clothes, and gas, went up a little bit every year. This means you would need more money to buy the same things you used to buy with less money. Inflation happens when there’s more money circulating in the economy, making demand for products higher than what’s available, so prices go up.

Deflation: Deflation is like the opposite of inflation. Instead of prices going up, they actually start going down. This might sound good, like things are getting cheaper, but it can cause some problems. When prices go down, people might decide to wait before buying things, thinking they’ll get even cheaper in the future. This can slow down the economy because businesses might not sell as much, which could lead to fewer jobs and less money circulating in the economy.

———————————

As the United States and China stand as the world’s dominant economic forces, their paths forward couldn’t be more different. fights. These contrasting economic woes have a profound impact on the daily lives of their citizens and carry global implications.

Inflation and Labor Market Dynamics

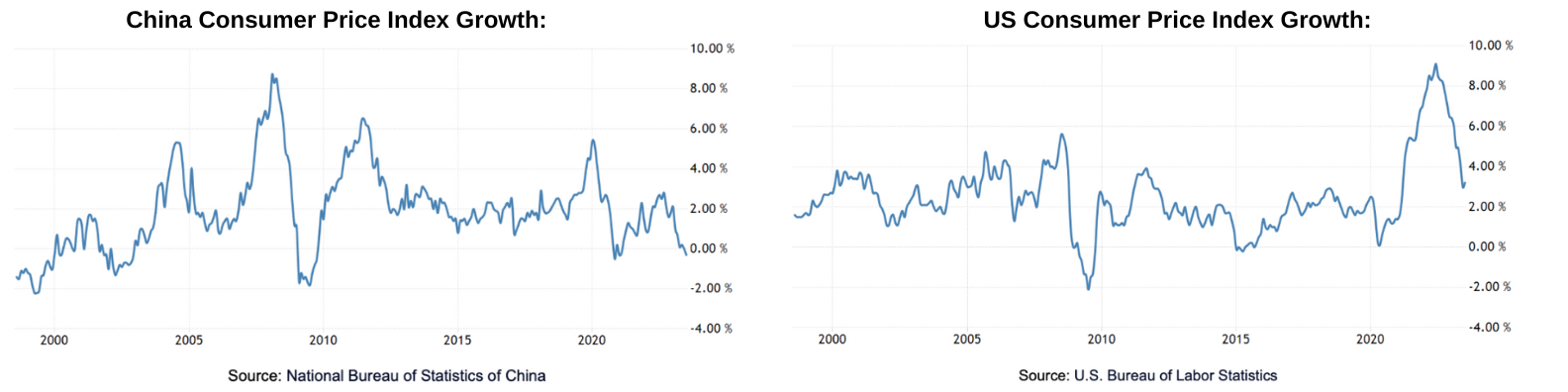

In the U.S., mounting inflation concerns have stirred unease as prices breach the Federal Reserve’s 2% target. In stark contrast, China contends with a deflationary spiral, with consumer prices falling 0.3% within a year. This dichotomy sets the stage for contrasting struggles within the superpowers. In contrast to the US Federal Reserve’s unprecedented balance sheet expansion to a soaring US$8.5 trillion, Beijing has refrained from using a large-scale loosening and withdrew coronavirus stimulus measures as early as the second half of 2020.

From a technical perspective, both have different weightings in their consumer price baskets. US consumers have been more prone to spikes in global energy prices and supply-chain disruptions during the Russia-Ukraine conflict. For all of 2023, the IMF expects China’s consumer price index to rise by 2 per cent, compared with 4.5 per cent in the US.

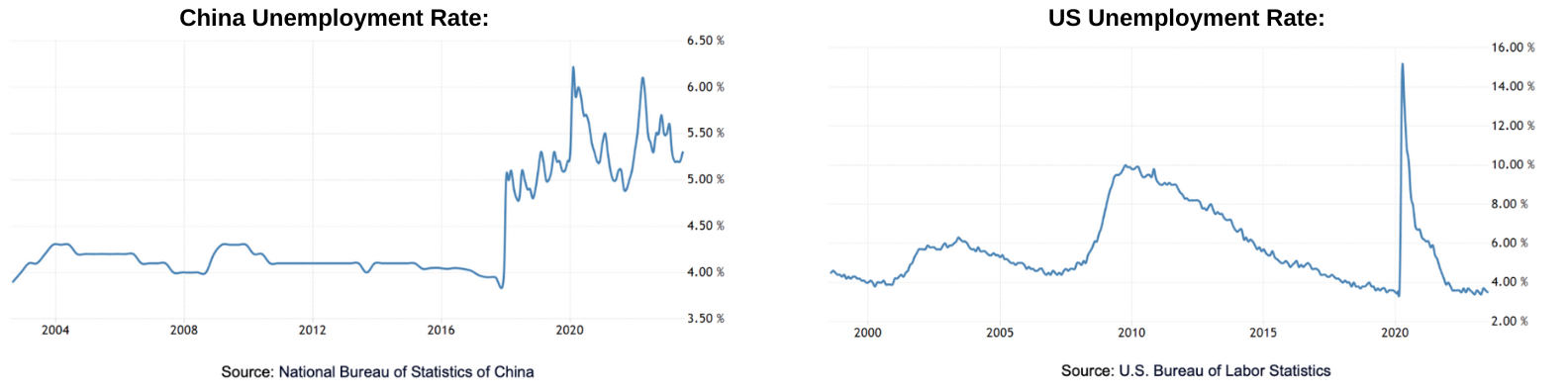

Amid the intricate economic journey of the United States, the labour market reveals an interesting narrative. A tight labour landscape is characterized by an abundance of job openings surpassing job seekers. Meanwhile, in China, the narrative takes a different turn, grappling with soaring unemployment, especially among the youth. A staggering 21% unemployment rate among 16- to 24-year-olds in China introduces another layer of complexity to their economic landscape.

Growth and Trade Challenges

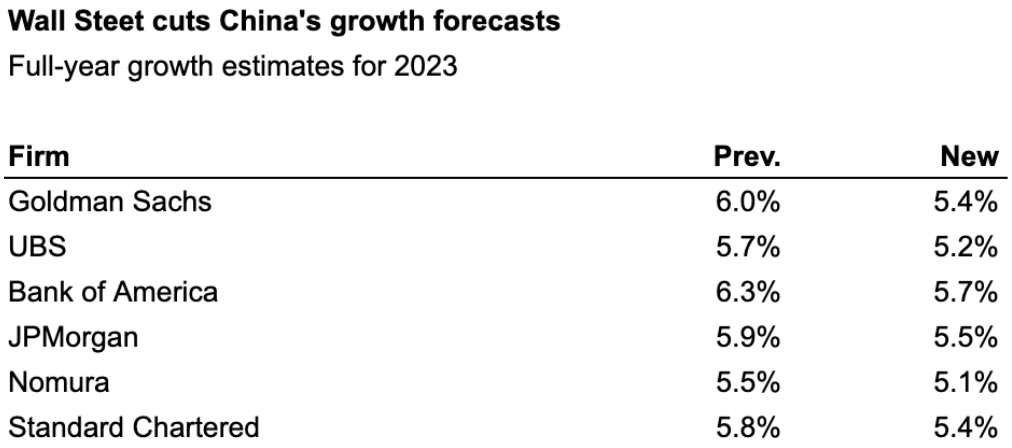

Turning our focus to China, growth and international trade come into play. Despite setting a 5% economic growth target, scepticism lingers due to comparisons with the pandemic-constrained year of 2022. Experts argue that a more realistic growth projection for a regular year could be around 3%. This closely aligns with the predicted 2.5% growth for the U.S.

Moreover, China’s international trade encounters hurdles. The convergence of a trade war and internal economic uncertainties contributes to a decline in international trade. China’s resolute “zero covid” approach, while potentially life-saving, leaves economic imprints as it curbs activities. Foreign direct investment dwindles, while government debt escalates, heightening apprehensions.

Both countries confront economic challenges while navigating distinct governance and geopolitical considerations. The U.S. steers through the dual challenge of inflation and employment equilibrium, guided by “Bidenomics.” Meanwhile, China grapples with economic anxieties in the wake of its rigorous pandemic policies. In the end, while the U.S. and China have distinct economic challenges, they are bound by their significance in the global landscape. Observing how each superpower navigates its economic journey will undoubtedly shape the world’s economic trajectory, affecting citizens, markets, and nations alike.

As an investor you should pay attention to how you are financially prepared for global macroeconomic headwinds and we recommend checking Alphanso, an AI platform that safeguards and grows your money by creating an optimal portfolio based on your style and market dynamics.

———————————

Think Investing, Think Alphanso

Through our accessible monthly service, Alphanso offers personalized AI-based stock recommendations, market insights, and portfolio management solutions, empowering retail investors to build and grow their wealth.