Top Picks in Lithium Industry:

ALB (Albemarle Corporation)

Alphanso Rating: 9.9/10: Fundamentals:

- Free cash flow yield of 4.35% indicates a very sustainable business

- Revenue growth (fwd) of 46% vs. 4% sector median and EBITDA growth (fwd) of 62% vs 1.8% sector median suggests that its products are highly competitive

- EBITDA margin of 37% vs. sector median of 17% suggests strong pricing power and economies of scale.

- The ROE of 50% vs. sector median of 8% indicates that its management is highly efficient and shareholder-friendly.

LTHM (Livent Corporation)

Alphanso Rating: 8.8/10: Fundamentals:

- Revenue growth (fwd) of 47% vs. 4% sector median and EBITDA growth (fwd) of 116% vs 1.8% sector median suggests that its products are highly competitive

- EBITDA margin of 52% vs. sector median of 17% suggests strong pricing power and economies of scale.

- The ROE of 25% vs. sector median of 8% indicates that its management is highly efficient and shareholder-friendly.

ETF: LIT (Global X Lithium & Battery Tech)

Lithium carbonate (Li2CO3) is a seemingly unassuming white powder that plays a pivotal role in a wide array of industries. It is a vital lithium salt utilized in diverse applications, and its market is a fascinating tapestry of grades, applications, and global dynamics.

In this comprehensive exploration, we delve into the intricacies of this market, from its various segments to the forces propelling its growth.

Segmentation and Grades

The global lithium carbonate market is a multifaceted landscape, defined by its segmentation into different grades and applications. Three primary grades dominate this arena:

- Technical Grade: This is a fundamental grade with a myriad of industrial applications. It often serves as a precursor for higher-purity lithium compounds.

- Battery Grade: Lithium-ion batteries are ubiquitous in our modern world, powering everything from smartphones to electric vehicles. Battery-grade lithium carbonate is the lifeblood of these power sources, requiring stringent quality standards.

- Industrial Grade: Beyond batteries, lithium carbonate finds its way into industries like glass and ceramics, aluminum production, pharmaceuticals, and cement production.

Applications: The Diverse Landscape

The versatility of lithium carbonate is exemplified by its diverse applications. Here are some key sectors where it plays a pivotal role:

- Li-ion Battery: Lithium-ion batteries are the backbone of portable electronic devices, from cell phones to laptops, and they’re the heart of the electric vehicle revolution.

- Pharmaceuticals and Dental: Lithium carbonate is employed in the pharmaceutical industry, particularly for mood-stabilizing medications. It also finds its way into dental applications.

- Glass and Ceramic: The glass and ceramic industry benefits from lithium carbonate’s properties, which enhance the quality of the final products.

- Aluminum Production: Lithium carbonate contributes to the aluminum production process, ensuring efficient and sustainable practices.

- Cement Industry: Even the construction sector benefits from lithium carbonate, as it aids in improving the quality of cement.

The Driving Forces

The global lithium carbonate market has been on a remarkable growth trajectory, driven by several compelling factors:

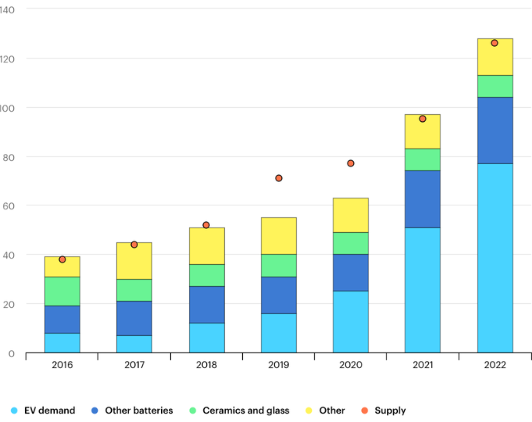

1. Surging Demand for Lithium-Ion Batteries: Perhaps the most significant catalyst for growth is the surging demand for lithium-ion batteries. These batteries have become the bedrock of our electrified future, powering not only portable devices but also the electric vehicle revolution. In 2020, global demand for Li-ion batteries reached a staggering 526 gigawatt-hours, and projections suggest it will reach a staggering 9,300 gigawatt-hours by 2030. Electric vehicle batteries alone account for 60% of total lithium carbonate demand, with another 20% driven by other batteries, including those used in consumer electronics and solar installations.

Overall supply and demand of lithium for batteries by sector, 2016-2022

Source: International Energy Association

Source: International Energy Association

2. Integration into Diverse Industries: Beyond the electric vehicle and energy storage sectors, lithium-ion batteries are permeating other industries such as consumer electronics, aerospace, and healthcare devices. This integration is propelling the market’s expansion.

3. Technological Advancements: Ongoing research and development efforts in battery materials are yielding more efficient lithium-ion batteries. These advancements are increasing the demand for lithium carbonate as a critical component in these batteries.

Market Projections

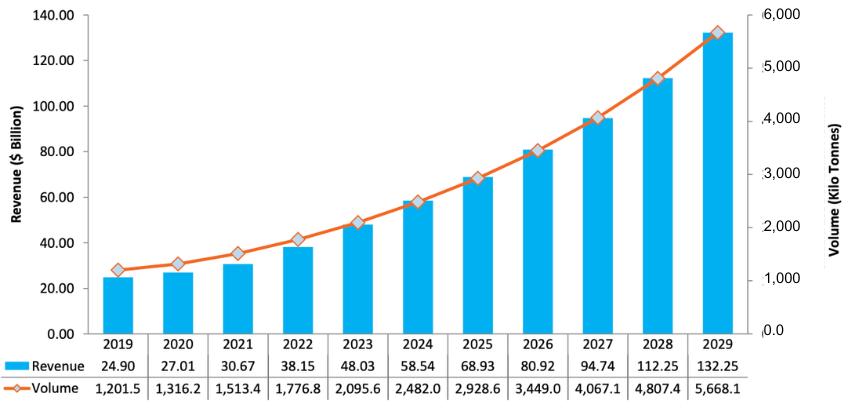

The market for lithium carbonate is poised for substantial growth. According to Frost & Sullivan (Aug 2023), the Lithium Battery Materials Market is anticipated to surge from USD 24.9 Billion in 2022 to a staggering USD 132.5 Billion by 2030, reflecting an impressive CAGR of 19.4%.Li-ion Battery

Materials: Revenue and Volume Forecast, Global, 2019-2029

– Revenue CAGR, 2022-2029 = 19.4%

– Volume CAGR, 2022-2029 = 18.0%

Source: Frost and Sullivan

Source: Frost and Sullivan

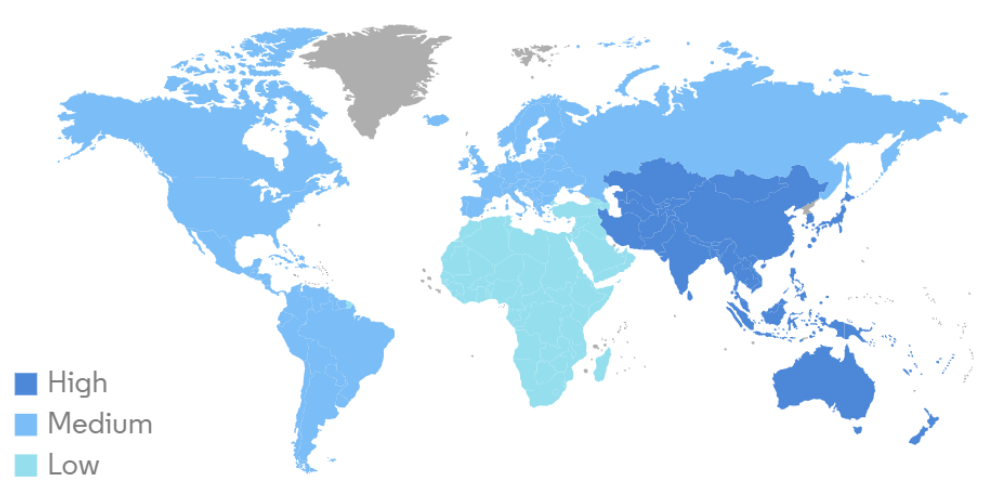

Regional Dominance and Growth Drivers

The Asian Pacific region dominates the global market, accounting for over 58% of the total volume share in 2022. Countries like China, Japan, South Korea, and India are at the forefront, boasting rapidly developing automotive, glass, and consumer goods industries. China has been investing heavily in building up capacity for Lithium mining/refining supply.

Lithium Carbonate Market – Growth Rate by Region, 2022-2027

Source: Mordon Intelligence

Source: Mordon Intelligence

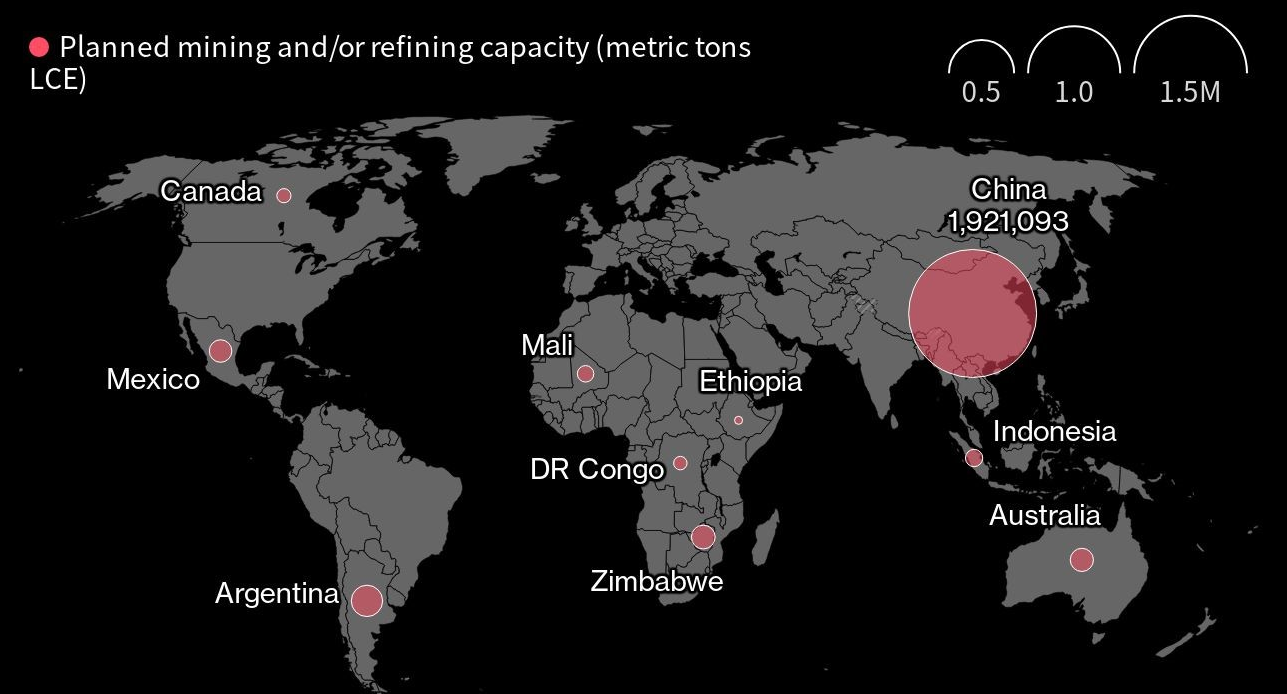

China’s Global Lithium Footprint

Largest investments in planned lithium mining and/or refining capacity:

Source: Mining.com

Source: Mining.com

Growth Drivers:

Li-ion Battery Materials: Growth Factors, Global, 2022-2029

Source: Frost and Sullivan

Significant Growth in Electric Vehicle (EV) Demand will Boost the Li-ion Battery Material Market

1. Government incentives and subsidies for zero-emission vehicles, stringent CO2 emission regulations, and competitive product offerings remain the key drivers for global electric vehicle (EV) sales amid various contributing factors.

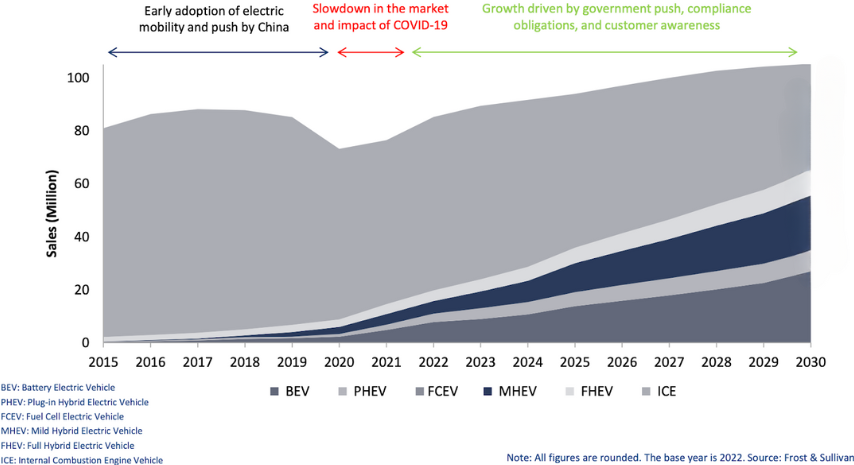

Electric Vehicles: Estimated Sales by Powertrain for Passenger Vehicles, Global, 2015-2030

Source: Frost and Sullivan

Source: Frost and Sullivan

2. According to IEA, in 2022, global expenditure on electric cars surpassed $425 billion, marking a significant 50% increase compared to the previous year. In addition, SUVs and large cars that need large battery sizes (kWh) dominated the EV markets, further driving battery material consumption.

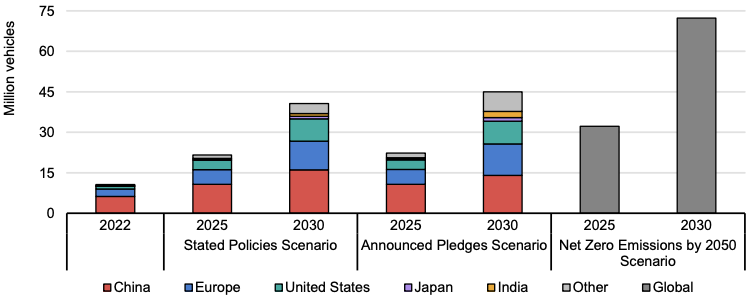

3. Further, by IEA, a scenario-based approach is used to explore road transport electrification and its impact, based on the latest market data, policy drivers, and technology perspectives. Two IEA scenarios – the Stated Policies and Announced Pledges scenarios – inform the outlooks, which are examined in relation to the Net Zero Emissions by 2050 Scenario at the global level. These scenarios are based on announced policies, ambitions, and market trends through the first quarter of 2023.

Electric vehicle sales by region, 2022-2030

Source: International Energy Association

Source: International Energy Association

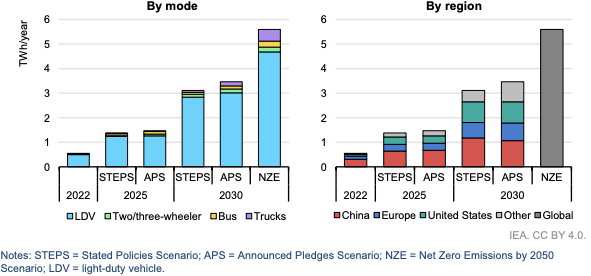

Projected battery demand by mode and region, 2022-2030

Source: International Energy Association

Source: International Energy Association

4. In addition, there is significant growth in MEASA for electric buses and three-wheelers. For example, India has set its 2030 targets to electrify 40% of buses and 80% of three-wheelers.

Growth in Stationary Energy Storage will Further Propel the Li-ion Battery Material Market

5. The demand for battery storage is expected to rise in the upcoming years. 2022 marked a significant milestone in the clean energy transition due to a combination of geopolitical, economic, and climate factors that prompted governments to accelerate climate action. As a result, governments have formulated long- term policies and plans to promote renewable energy and battery energy storage (BES), which is a crucial component for providing the flexibility and resilience required by modern energy systems.

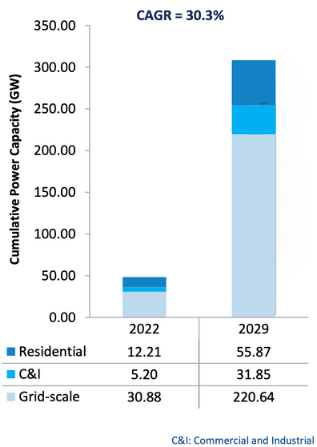

Li-ion Battery Materials: Battery Energy Storage, Cumulative Power Capacity Forecast by Segment, Global, 2022-2029

Source: Frost and Sullivan

Source: Frost and Sullivan

6. As the world transitions toward renewable energy, energy storage becomes increasingly important. According to Frost & Sullivan, Lithium-ion batteries currently dominate 90% of grid battery energy storage worldwide, especially for wind and solar energy.

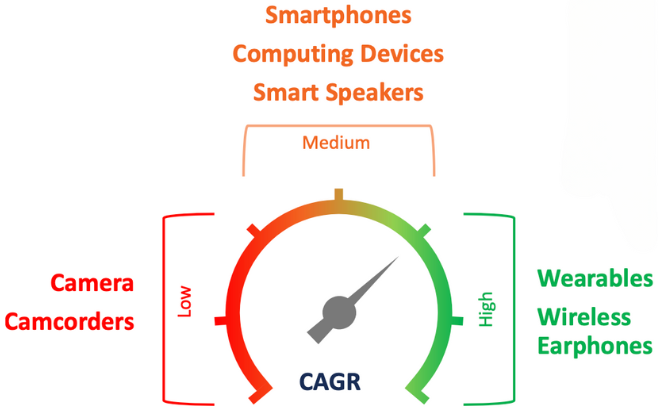

Steady Growth in Consumer Electronics will Continuously Drive the Need for Battery Materials

Li-ion Battery Materials: CAGR by Product Type, Global, 2022-2029

Source: Frost and Sullivan

Source: Frost and Sullivan

7. Rising disposable income and discretionary spending in key markets, along with the widespread availability of affordable internet access and online services, such as eCommerce, as well as the anticipated rollout of 5G technology, are expected to be drivers for the consumer electronics industry over the next 7 years.

8. Smartphones and laptops have transitioned from being luxury items to essential tools. Similarly, other technologies, such as smartwatches, earphones, and other gadgets, are expected to experience similar shifts in consumer perception, becoming necessary products rather than discretionary purchases, which is expected to contribute to their growth in the market.

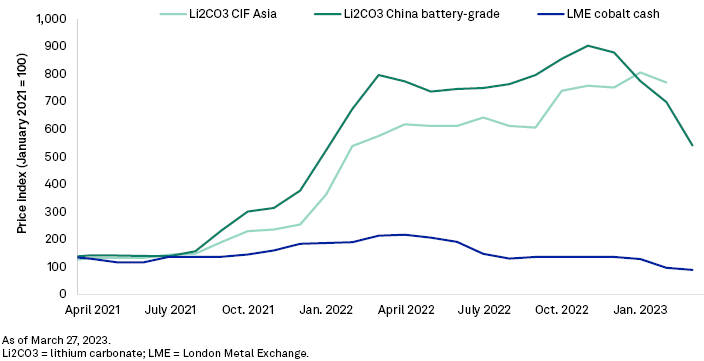

Lithium Price Movement:

The price of lithium has experienced significant fluctuations in recent times. Lithium mining and production has been a high-margin activity due to limited players in the industry. Prices soared as electric vehicle manufacturers rushed to secure raw materials, driving lithium carbonate prices up more than six-fold and spodumene (stone of Lithium Carbonate) up nearly ten-fold. However, battery price reductions, aimed at expanding access to consumers, have impacted lithium prices negatively.

In February 2023, rare discounts offered by Chinese battery giant CATL to automakers accelerated a plunge in lithium prices.

Lithium prices drop sharply; cobalt prices stabilizes

Source: Benchmark Mineral Intelligence, London Metal Exchange, Shanghai Metals Market

Source: Benchmark Mineral Intelligence, London Metal Exchange, Shanghai Metals Market

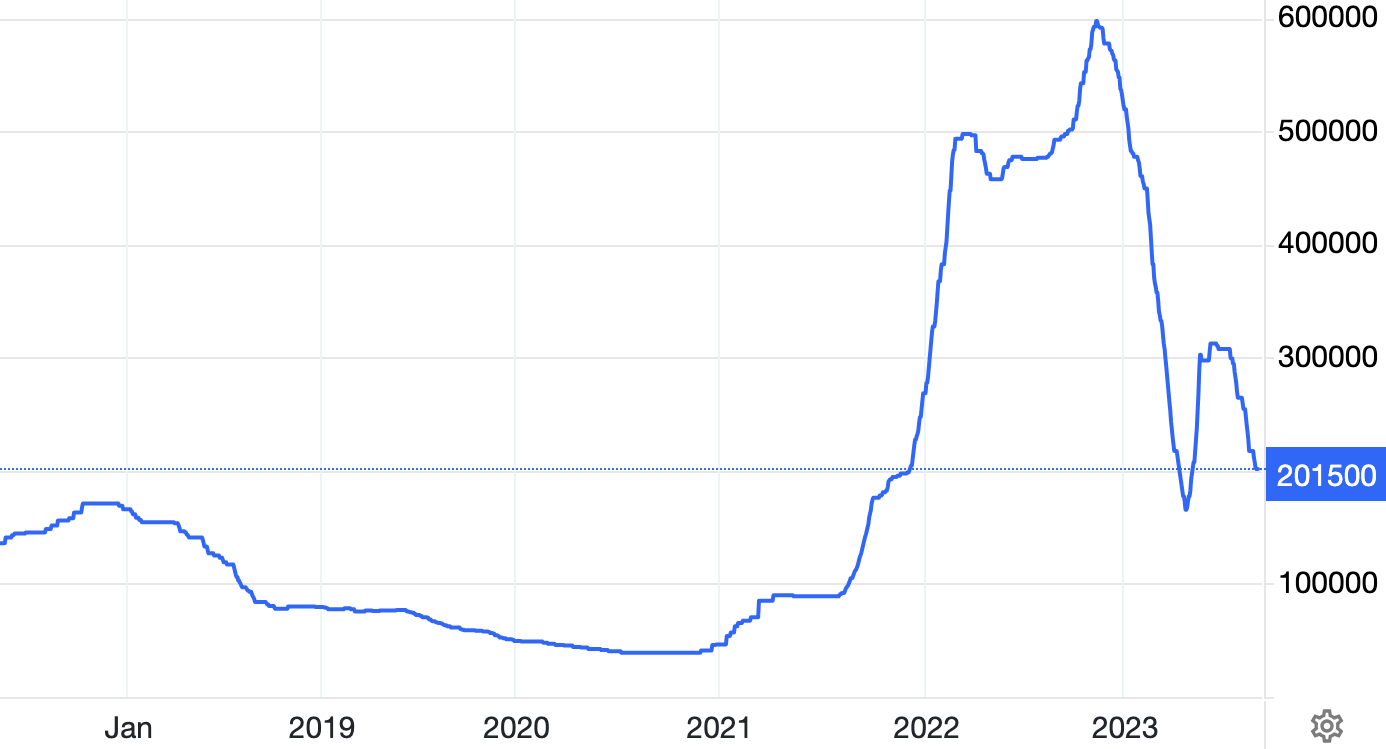

More recently, China’s battery-grade lithium carbonate price dropped 20% from August 1 to September 1, 2023, reaching 201,000 yuan/t ($27,652/t excluding value-added tax). This marked a 66% decrease from its peak in November 2022 at 590,700 yuan/t. The price decline reflects a sluggish global Plug-in Electric Vehicle (PEV) sales recovery, reduced consumer capacity to pay for lithium, battery and automaker price reductions, expected lithium supply increases, and inventory build-up.

Lithium Carbonate Price (CNY/T)

Source: Trading Economics

Source: Trading Economics

Product inventory is rising at lithium refineries due to weak demand coupled with low willingness to restock by precursor and battery makers. In a falling price environment, producers throughout the lithium supply chain face the added pressure of cost-to-price mismatch: lithium units are more expensive at time of purchase than when sold as refined and processed products. The uncertainties over the timing of the demand recovery under a bearish price environment make for testing times for lithium producers.

Lithium Price Outlook:

The forecast for lithium prices remains stable in the medium term. Several factors contribute to this stability:

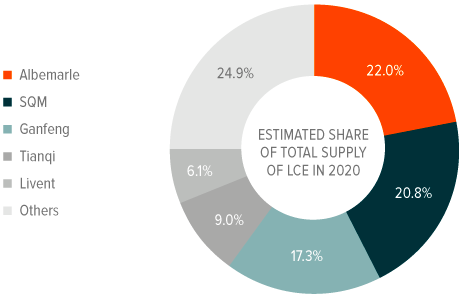

1. Limited Players: In 2022, 52% of the global lithium supply was dominated by 5 top players. This results in an oligopoly, coupled with high barriers to entry into the industry making it challenging to lower prices. “It takes 4 to 7 years to build a lithium mine. It takes only 24 months to build a battery plant. These two parts of the supply chain, they don’t live in the same time zone.” Simon Moores of Benchmark Mineral Intelligence on the pending supply-demand imbalance

Current Lithium Supply is Oligopolistic in Structure

Source: RK Equity

Source: RK Equity

2. Long mine development and production cycle: A reliable prediction of timelines is essential. Considering past projects, it can take up to 10 years to develop and produce Lithium from the mines, depending on the type of resource. This means a high barrier to entry for competitors, and hence, limits any price reduction. However, considering the long-term, competition and operational efficiency can reduce prices while continuing to earn a significant margin.

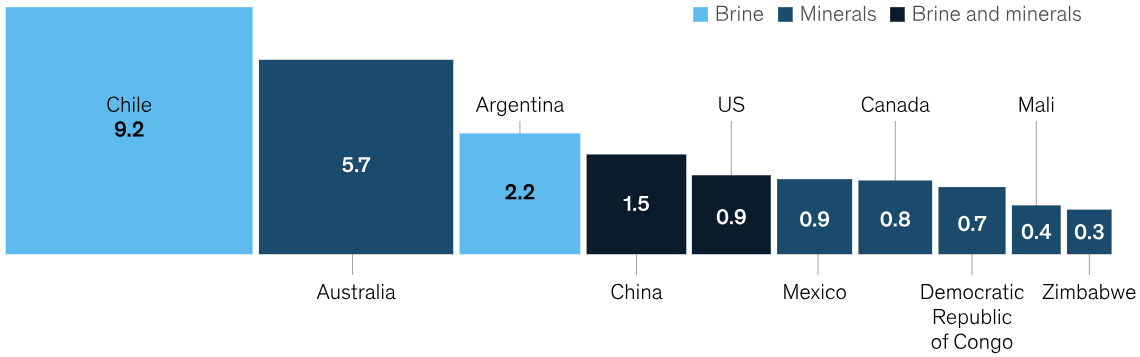

Top 10 countries with largest lithium reserves, million metric tons

Source: United States Geological Survey, MineSpans

Source: United States Geological Survey, MineSpans

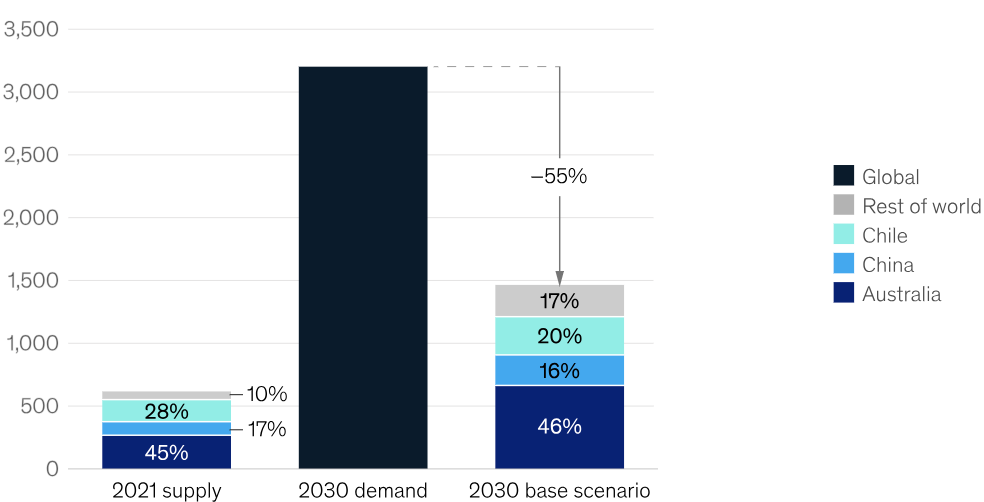

3. Supply vs Demand: In addition, the demand for lithium is significantly higher than the supply offered and is projected to continue to be so until 2030, making it further harder to reduce prices.

Lithium Carbonate global equivalent demand 2030, supply 2021 and 2030 by country, kT

Source: McKinsey & Company

Source: McKinsey & Company

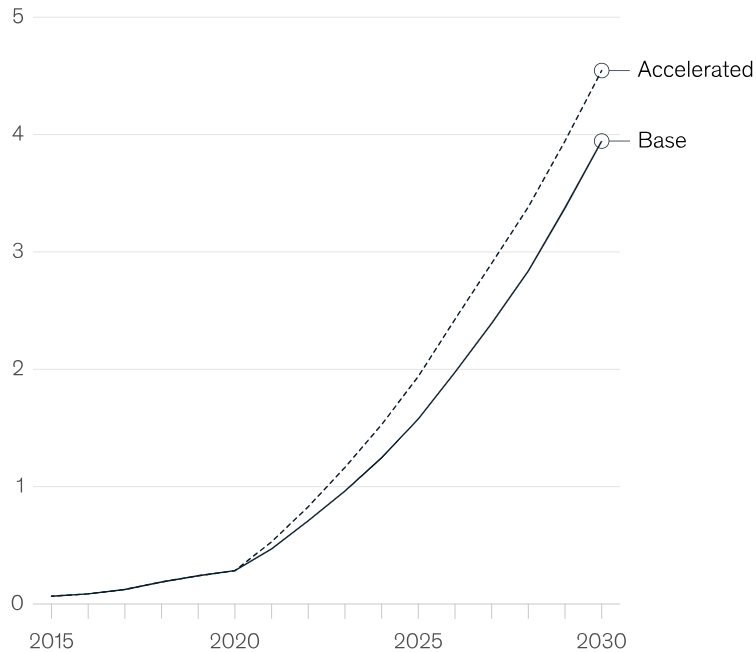

Global lithium-ion battery demand by scenario, thousand gigawatt-hours

Source: McKinsey & Company

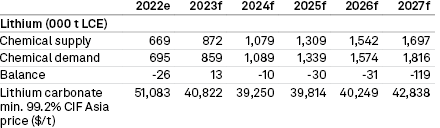

Short-term forecast: S&P Global Market Intelligence expects a steep decline in the lithium carbonate CIF Asia price for the short term — a 20.1% drop year over year in 2027 as more drastic discounts on ICE vehicles could slow the PEV sales recovery in China.

Source: S&P Global Market Intelligence

Conclusion:

In a world where the future hinges on sustainable energy, electrification, and technological innovation, lithium carbonate stands as an unassuming hero. This white powder, often overlooked, is the linchpin of a revolution, driving the evolution of industries, from electric vehicles to energy storage and consumer electronics.

The lithium carbonate market is not merely a marketplace; it’s a testament to our collective commitment to a greener, more electrified future. It thrives on the relentless demand for lithium-ion batteries, which power not only our daily gadgets but also the very vehicles propelling us toward a cleaner, more sustainable tomorrow.

Price fluctuations may ebb and flow, but the market’s long-term trajectory is undeniably upward. With limited players, lengthy mine development cycles, and insatiable global demand, significant price reductions remain elusive.

As we traverse this electrified landscape, lithium carbonate remains at the forefront, a crucial component in our transition to a cleaner, more technologically advanced world. It’s not just a commodity; it’s a catalyst for change, a symbol of progress, and the force that propels us toward a lithium-powered future.