What plagues the mind of investors lately? The convergence of geopolitical issues, from the Fed’s tightening to the concerns of an impending recession, 2022 has been a walk on eggshells for them.

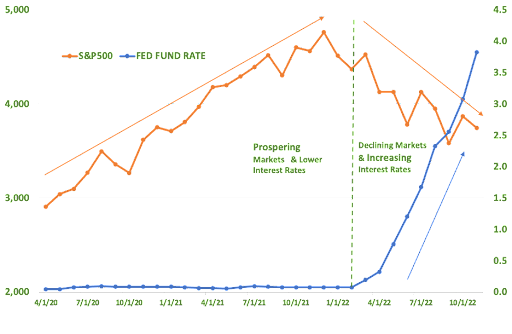

The current market havoc has been majorly influenced by aggressive interest rate hikes by the Fed, as shown in the chart below.

Why increase the interest rates?

Inflation has long surpassed the Fed’s criteria of 2 percent. Even so, they believe that by raising the cost of borrowing, consumers and businesses will be less inclined towards loans for purchase. This upsurge in borrowing costs will initiate lower demand for goods and put brakes on the accelerating prices.

Impact on Stock Markets

The cost of running a business rises as the Fed increases interest rates. Gradually, increasing costs and curtailed business activities decreases revenues and earnings for public firms, potentially affecting their growth rate and stock price.

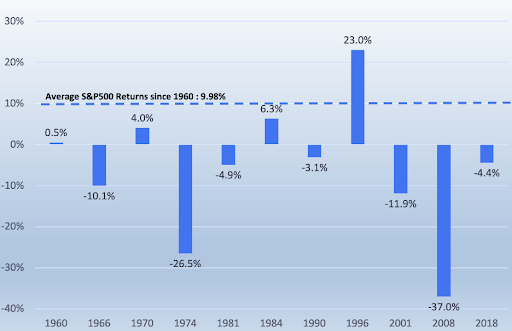

As shown in the below chart, the Fed rate hikes have generally stirred the S&P500 to go way below its average return of 9.9%.

Good News, Bad News

The most likely scenario will look like an illustration from Jeff Mack’s book Good News, Bad News. The Fed is facing an uphill battle of bringing inflation down without significantly damaging the US economy. Interestingly, the Fed’s neutral rate of interest is about 2.5%. For now, we are beyond it, and the interest rate rising above it indicates a coiling economy. Still, Fed is likely to continue raising interest rates, albeit slow-footed. Fed Chair Jerome Powell has already signaled that interest rates might climb above 4.5-4.75 percent by the end of 2023.

Collaterally, landing the overheated US economy will become a Herculean task. A recession is likely to be seen before the interest rates return to neutral rates, at the least. Suffice it to say the Fed is in for a bumpy ride while monitoring the rate hikes.