What makes a market maven? They are adept investors with the ingenuity to perform rigorous research in the many intricate aspects of investment strategies. They implemented their approach in a disciplined and consistent manner to maximize the edge discovered through analysis.

But who can do that better today? Human or Artificial Intelligence (AI)

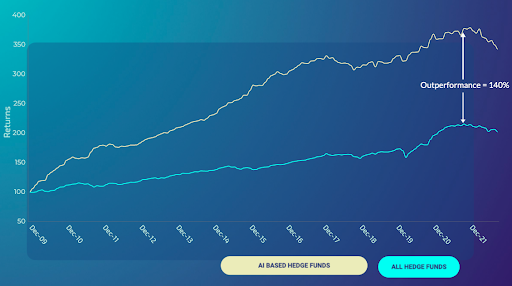

The chart below sheds light on this subject. It compares the performance of AI-based hedge funds and all hedge funds over the last 12 years.

AI is Everywhere

AI is a revolution that has touched every life and every eminent industry. Movies, music recommendations, shopping, or self-driving cars; from one end of the spectrum to another, now, AI is everywhere. Even the stock market has not been immune to the power of this technological breakthrough.

AI is Fast and Extensive

AI uses robust techniques to crunch almost countless data pointers in a minute. It can detect historical patterns and replicate them for smart trading that would otherwise be incomprehensible to a human mind. Additionally, they can be automatically updated while gathering new data without the obligation of human supervision. Some of these AI systems even facilitate companies to dig through diverse social media venues and gauge consumer, market, and investor sentiment.

The Plight of Retail Investors

The concept of AI is not a novelty to some in the investing world. Thus far, many investment managers have been leveraging AI models and regard themselves as more of a technology company. Most ultra-high-net-worth individuals and institutions already have access to these investment managers. However, until now, this cutting-edge technology has been out of reach for retail investors. In today’s world, where trading has become so accessible and affordable, generating sustainable returns is still far from reality for most retail investors. Thus, affordable access to AI becomes quintessential for retail investors to manage their investments.

AI is Hard to Implement

However, implementing AI in investing is still a far cry compared to many other domains. A systematic approach to testing and continuous improvement in the quality and quantity of data fed into the system is crucial to any AI model. Consequently, domain knowledge in finance paired with a meticulous and comprehensive research process is essential for the sustained success of the models.

Future is Bright

AI has made some inroads in shaping the future of the investment management industry. This is just the genesis of something great to come. Given AI’s ability to evolve and continuously transform into a futuristic set of features, it is destined to aid investors at every junction of their investment management. Ergo, the democratization of Artificial Intelligence will soon become the groundwork for the changing landscape of investing.