Inflation has gone into overdrive. 2022 saw a 17% dive in the S&P 500, and a potential recession is already hanging over our heads; mercurial market situations like these have made people understandably jittery about their finances.

Investors are getting cold feet from financial uncertainty, pushing them to rethink their investment choices. In the midst of all this, they face the dilemma of either carrying out stock picking or exchange-traded funds (ETFs).

ETFs famously rose in the investing world because of low-cost and diversified index fund management. However, the zero-cost trading revolution has motivated retail investors to pick stocks with renewed enthusiasm. People are learning about the untapped potential of their money and becoming tech-savvy by using investment and trading apps.

There are several reasons why stock picking could be a better option than ETF investing over the years to come:

1. Current Market Dynamics

The stock market will likely remain erratic for a considerable period, given Fed tightening and limited earning growth potential with a looming recession. According to Goldman Sachs Research, the S&P 500 Index may deliver flat returns and no growth in earnings in 2023.

Thus, stock picking with an optimal portfolio construction becomes an attractive bet in the markets that will probably remain range-bound, and ETFs are liable to generate flat or nominal returns.

2. A new cycle on the horizon

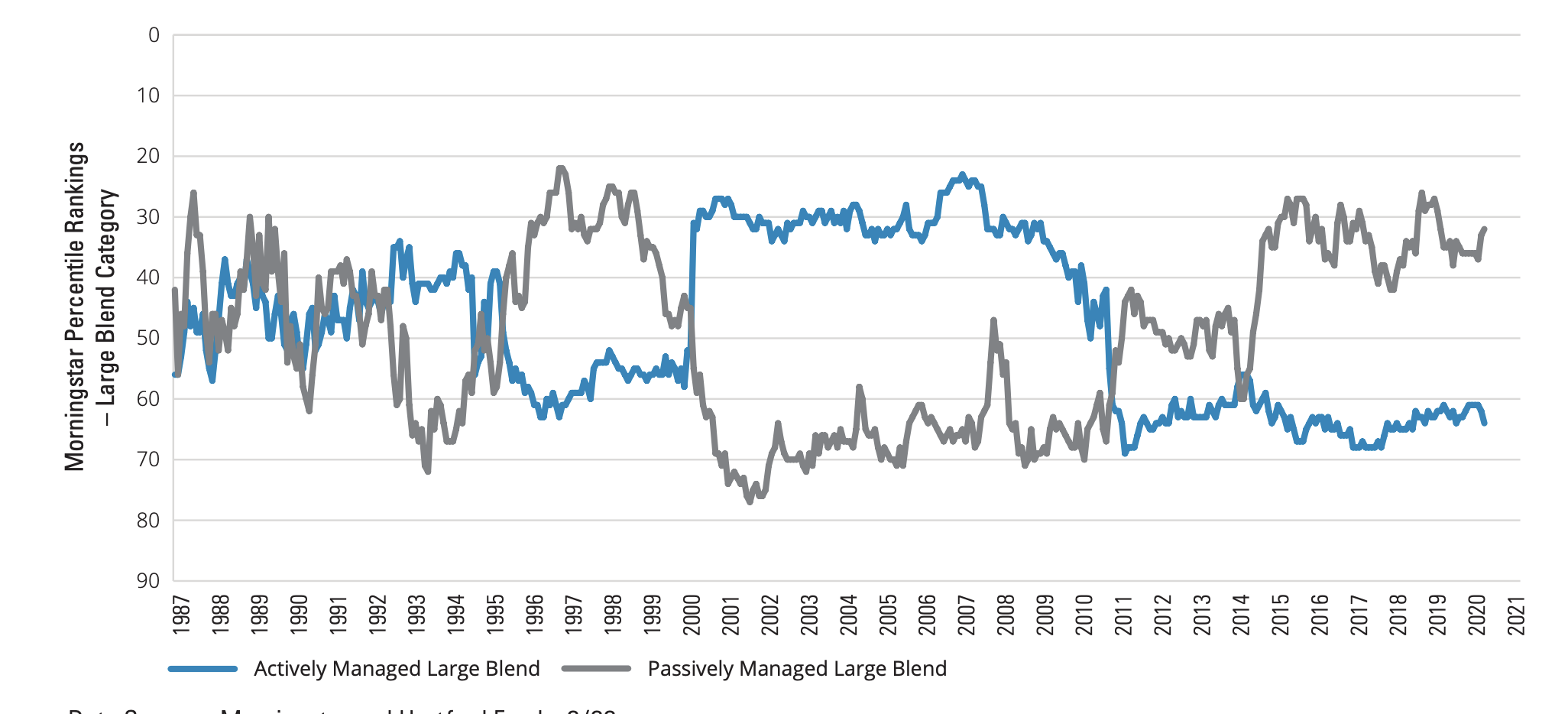

Active equity collectively underperformed its passive counterpart over a large part of the last decade. However, a Hartford Funds study derives the graph below, illustrating the cyclical nature of this pattern. Since early 2021, market conditions have turned optimistic for active equity investors, signaling an extended period where active investors will probably enjoy superior returns over their less-engaged peers.

Active and Passive Outperformance Trends: Rolling Monthly 3-Year Periods (1987–2021)

3. Tipping Point

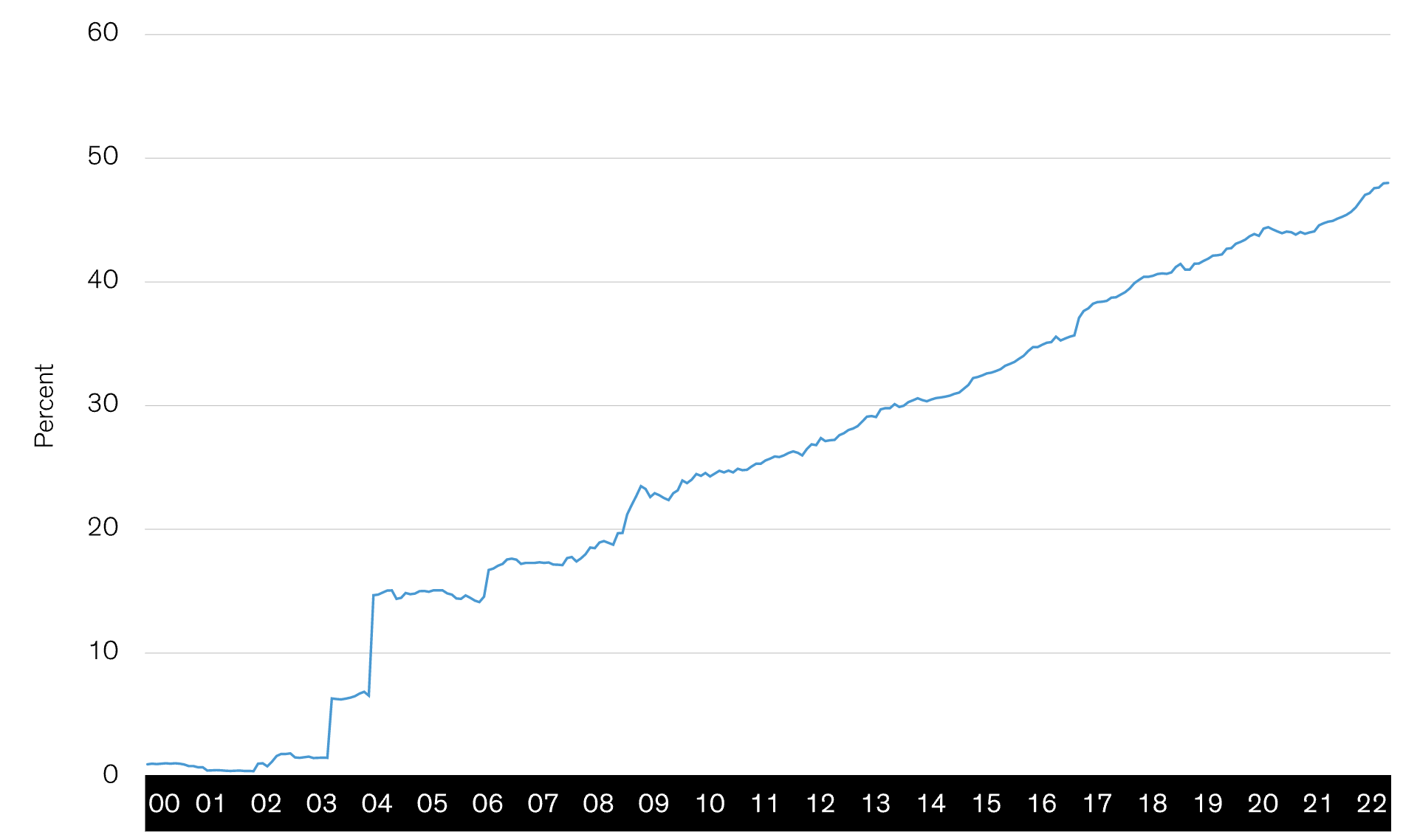

The market becomes more informationally ineffectual as the stocks held by passive investors (ETFs) grow, providing better opportunities for active investing. Passive trade funds add little market efficiency since they are driven by investor flow, while information-gathering active investors trade in stocks priced inefficiently.

Passive Share of Global Equity AUM

4. Cost

With zero-cost trading and low-cost investment management solutions, ETFs are losing the edge of being cost-competitive. For most ETFs, the expense ratio is higher than those for owning stocks, meaning investors pay more to own an ETF than they would pay to own the stocks in the ETF.

5. Control

Stock picking is more promising than ETF investing for greater control over the how-when of investing; while providing potential returns and diversification. Investors can blend their values, tax management, and quality through extensive research. Additionally, stock picking can become a way to hedge against risk by selecting resilient stocks against market volatility.

Conclusion

Directly investing in stocks can be tedious, and there’s no guarantee of beating the market. But with the right tools and technique, one can generate sturdy returns and conquer the market. And for those with no time for investment management, investing in ETFs is presumably a good move. Ultimately, buying ETFs is undoubtedly better than not investing at all.

Whereas in the current dynamics, the stage is set for stock pickers to demonstrate their skill.